March 2020 was undoubtedly a painful month for investors. Global stock markets plunged, the oil price collapsed and parts of the world economy came to a standstill. The falls seem all the more shocking after a decade-long bull run in which markets surged to record high after record high.

Is it just that investors forgot what a bear market feels like, or will March 2020 go down in the history books as one of the worst of all time?

The Worst Month Since...

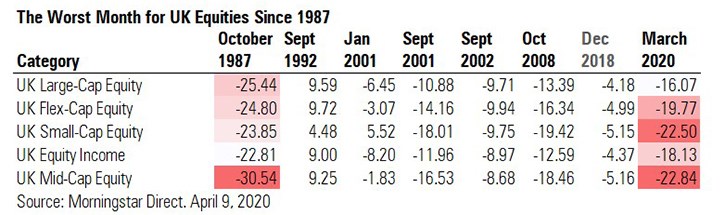

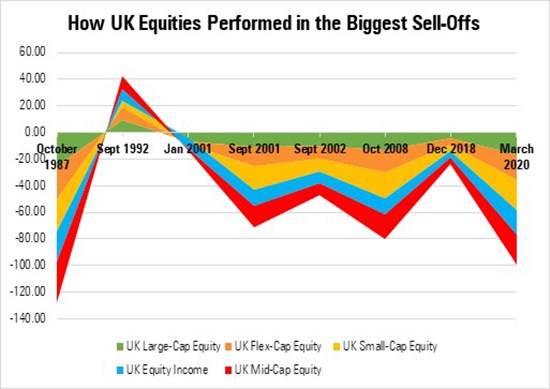

Morningstar Direct data shows that March 2020 was, in fact, the worst month for UK equities since October 1987. We analysed the monthly performance of the various UK equity Morningstar Categories dating back to 1972 (when our data starts) and found that March 2020 was the second worst month for UK equities over the period.

The Small- and Mid-Cap Morningstar Categories were the weakest in March, down 22.5% and 22.84% respectively, while the UK Large-Cap Equity proved most resilient in the coronavirus sell-off, down 16.07% in the month.

Compare that with October 1987, when an unexpected crash obliterated global stock markets. The US was down more than 20% in a single trading day, which would become known as Black Monday. Computer trading programs automatically piling sell orders upon sell orders were blamed as a major contributor to the panic, along with military conflict and trade issues.

That month, mid-caps were also the worst hit of UK equities, with the category down an eye-watering 30.54%. Even the best-performing category, UK Equity Income, plunged 22.81%. And, while the market has seen a number of recessions and sell-offs since, the chart below shows that none of the subsequent falls has come close.

September 1992 was the month that the UK crashed out of the European Exchange Rate Mechanism (ERM) after a collapse in the value of the pound. The ERM had been created in preparation for the euro, to keep European currencies within a range of each other.

September 16 that year became known as Black Wednesday but the effect on the stock market appears to have been minor. All UK Equity categories were, in fact, in positive territory for the month. The weakest was UK Small-Cap, which returned 4.48%, while the UK Flex-Cap Equity category was up 9.72%.

Markets saw two major sell-off in 2001, the first prompted by the bursting of the dotcom bubble and the second after the 9/11 terrorist attack. The latter had a far more significant effect on markets, data shows, with all UK Equity categories down at least 10% in the month. Small-caps were, again, the worst hit, down 18.01%.

And the Worst Quarter, Too

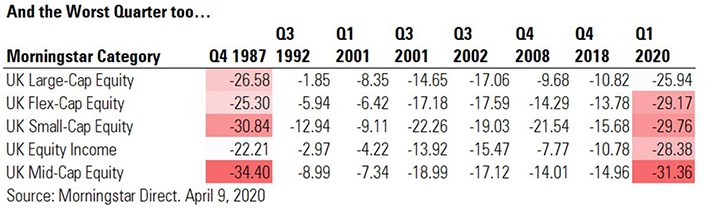

The same trends are evident when we look at returns on a quarterly basis, too. The UK Equities categories fell as much as 31.36% in the first three months of 2020 and, again, this is the worst performance since 1987.

In the fourth quarter of 1987, the UK Mid-Cap Equity category plunged 34.4% and Small-Caps 30.84%. In the first quarter of this year, the categories are down 31.36% and 29.76% respectively. Again, if we look at some of the most high-profile periods of volatility since 1972, we can see that no period has been as bad as either of these.

In the fourth quarter of 2008, in the depths of the global financial crisis, even the worst hit UK category was down just 21.54%. UK Equity Income, meanwhile, fell a more bearable 7.77% and UK Large-Cap Equity 9.68%.

More recently, in the last quarter of 2018, all UK equity categories were down more than 10% but the worst among them – small-caps – fell 15.68%, only around half the fall it endured in the first quarter of this year.