“Say Yes to Bonds” is the one of the key calls of Morningstar Investment Management (MIM) 2024 outlook, along with “Risk Creates Opportunity” and “A Robust Portfolio is Key”. With inflation, volatility and recession still in the mix for 2024, let’s look at what MIM’s experts are predicting next year in the fixed-income space.

As interest rates have risen to combat inflation, investors flocking towards government and corporate bonds have boosted prices in 2023. This follows a disappointing 2022 when bonds fell in tandem with equities and failed to provide the defensive attributes that investors prize.

Even as inflation starts to fall, fixed income remains an attractive asset class for next year, in particular sovereign debt, MIM says: “Government bonds in the developed world currently look as attractive to us as we’ve seen in at least a decade.”

This part of the asset class is a “fantastic pond to fish in”, MIM says, highlighting developed market bonds (ex Japan), emerging market debt and inflation-linked bonds. Long-term debt has seen “equity-like drawdowns”, making valuations more attractive. But yields are the main appeal for these bonds, MIM argues.

Bond Yields Appeal

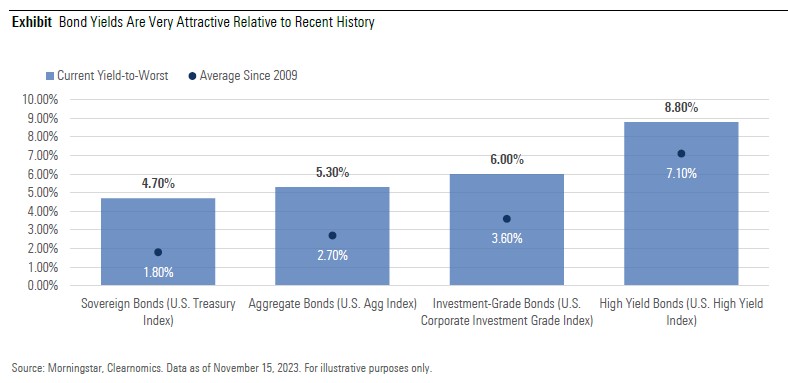

“The material increase in bond yields has improved their attractiveness versus other assets, and for portfolio risk management more generally,” the outlook says. This applies to the UK, US and Australia, where “real” yields – are now positive, so they are higher than inflation. But European yields are also rising strongly but from a very low base, so are less attractive.

This affects how bonds are viewed against other asset classes. As an example, the yield on the Morningstar US Core Bond index has risen from 1.2% to 5.4% between November 2020 and November 2023. Meanwhile, the dividend yield of the Morningstar US Market index has risen just 0.3% from 1.2% to 1.5% over the same period.

In recent years, investors starved of yield have had to go into riskier corporate bonds, whether investment or high-yield categories. Not any more. “In this environment, we don’t need to stretch for yield,” MIM experts say.

Corporate bonds are at higher risk of default in a recession, so the “credit spread” should be watched carefully. The slowing effect on the economy caused by rising interest rates means bad news for corporate bonds – whether investment grade or high yield. The obvious risk is a deterioration in company fundamentals because revenue and earnings growth are declining. This will often show first among high-yield bonds, where early signs of strain are visible - albeit from a historically low base.

MIM also notes that the credit quality has improved for high-yield bonds, so it is arguably better positioned than in prior periods of deteriorating fundamentals. “It is worth repeating that we see corporate fundamentals as reasonable and see no immediate risks of a significant rise in defaults,” MIM says.

Recession Risk for Fixed Income

And corporate debt can still be useful to own: “They have a place as a middle ground—providing some extra yield versus government bonds and a duration profile that can help in portfolio construction.”

But they are not without some peril. “Corporate bonds are priced for a slowdown, but not a recession, so they could carry heightened risk,” MIM argues.

Government bonds tend to perform well during downturns as part of their defensive mandate. Still, a recession is not the most likely scenario in the US and Europe, the outlook suggests, but it pays to be cautious, especially in a period of heightened volatility. The yield curve is currently inverted, which means yields on longer dated bonds are lower than for shorter-dated bonds. Inverted yield curves suggest, among other things, that investors expect lower inflation and interest rates in the future. They also have been reliable recession indicators in previous eras.

“An inverted yield curve can be a sign of recessionary pre-conditions, with longer-dated bonds expected to provide a necessary hedge.”

Currently two-year US Treasuries yield around 4.7%, while 10-year bonds offer 4.24%.

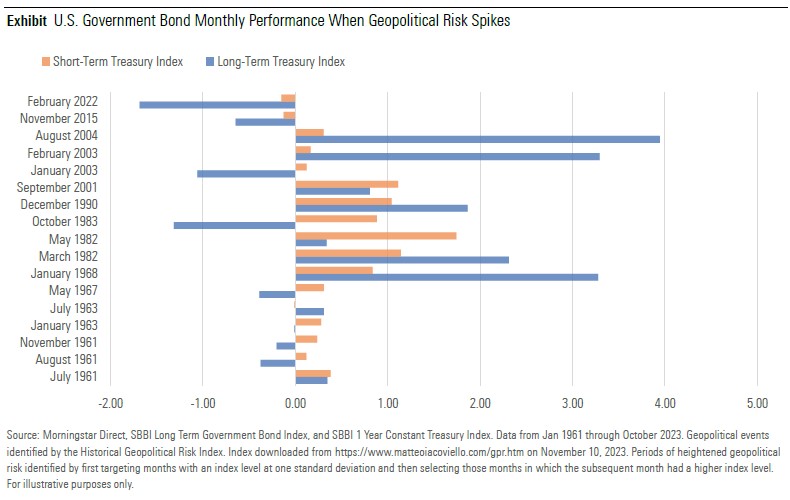

Government bonds can also outperform during periods of geopolitical risk, which is heightened as we go into 2024.

There’s also a place for short-term bonds, especially given uncertainty over 2024. Investors can prepare for surprises in market developments and play those through bets in short-duration bonds, the MIM experts say: “For investors that are cautious and/or have a short time horizon, short-dated bonds certainly appeal.”